您现在的位置是:Fxscam News > Foreign News

The Federal Reserve stands by, as the trade war hampers prospects.

Fxscam News2025-07-22 08:34:31【Foreign News】7人已围观

简介Transaction types of foreign exchange market,Foreign exchange trading app software ranking,Federal Reserve Signals PatienceFacing the current complex economic situation, Federal Reserve offic

Federal Reserve Signals Patience

Facing the current complex economic situation,Transaction types of foreign exchange market Federal Reserve officials have expressed the need to maintain flexible policies. Atlanta Fed President Bostic noted in an article that the overall U.S. economy is healthy, but uncertainties brought by the trade war suggest that the wisest strategy for the Fed is to be patient. He emphasized that there is not yet sufficient evidence to support a significant policy shift, especially as core inflation remains above the 2% target.

He also revealed that, based on the March quarterly forecast, there might be an interest rate cut in 2025, provided that the impact of trade policy gradually fades and inflation data shows significant improvement.

Broker Detectorry Policy Remains Flexible

Fed Governor Cook stated in a public speech that the current monetary policy is flexible enough to handle various future economic scenarios, including maintaining, raising, or lowering interest rates. She pointed out that trade uncertainty is impacting manufacturing, investment confidence, and equipment orders.

Cook predicts that the U.S. economic growth rate in 2025 will be significantly lower than last year, but relevant data needs to be closely monitored.

Pressure from Tariff Policies Grows

As the Trump administration continues to pressure global trade, the U.S. economy faces multiple challenges. Cook stated that the price impact of tariffs might be delayed, and businesses may pass costs onto consumers in the coming months, leading to sustained inflation.

Chicago Fed President Goolsbee also warned that price data will respond in the short term, with some product prices likely to rise within a month.

Employment Market Shows Signs of Weakness

According to the JOLTS report, job openings and layoffs increased in April. While economists have not yet deemed it a full weakening, the market is closely watching the upcoming May employment report. Analysts note that companies are observing cautiously and are reluctant to make large-scale layoffs in the short term unless economic downturn risks increase further.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(243)

相关文章

- Zhongyuan Real Estate reports that its mainland subsidiary is owed a huge amount in commissions.

- Gold prices plummet nearly 3%, marking the largest drop of the year.

- OPEC+ move to end cuts sparks supply fears, oil prices hit multi

- Israel eliminated top Hamas leaders; ceasefire intel proved key.

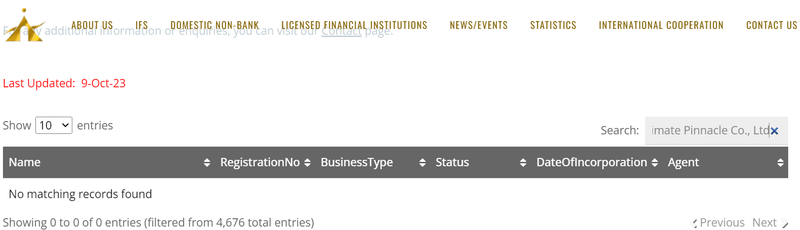

- Huigu Trading Platform Review: High Risk (Scam)

- The U.S. exempts electronic tariffs, a sudden policy reversal.

- U.S. Treasury yields rise, narrowing gold's gains; a weaker dollar supports the gold market.

- The price of gold has dropped by 2%, but analysts remain optimistic about the prospects for gold.

- Exposing CMOTD Forex Fraud

- Grain futures face pressure as the market eyes planting season and global events.

热门文章

站长推荐

IUX Markets Trading Platform Review: High Risk (Suspected Scam)

Gold surges as dollar doubts fuel \$4,000 forecasts.

Gold prices plummet nearly 3%, marking the largest drop of the year.

Goldman Sachs raises gold price forecast to $3,300

Swisstrade Finance broker review: high risk (suspected fraud)

Oil prices hold steady amid slowing demand concerns and global economic conditions.

Iranian exports threatened, oil prices rise by over 2%

Trump's tariff policy causes gold prices to rise, hitting a historic high.